- Home

- Our Platforms

UNICORN FOREX BROKER

Lightning-fast, brilliantly smart, and boldly beyond any crypto exchange

Custodial Wallet, Payment Gateway, Managing Digital Assets

Blockchain Explorer

- About

With extensive industry experience, we take pride in delivering exceptional customer service and offering premium, innovative products known for their reliability.

Our dedicated team brings a wealth of expertise and passion to everything we do. Each member is committed to delivering outstanding service and innovative solutions for our clients.

Find answers to common questions about our services, products, and support. If you need further assistance, don't hesitate to reach out to us directly.

Stay informed with the Latest Updates from UNFXCO! Explore the newest features and announcements to elevate your trading experience.

- Services

- Broker Liquidity Provider

- Prop Trading Solution

- Start Main Lable Forex Brokerage

- Get Broker Regulation

- White Label Crypto broker

- Custodial Wallet Provider

- Cryptocurrency Exchange API Provider

- PROP FIRM CRM

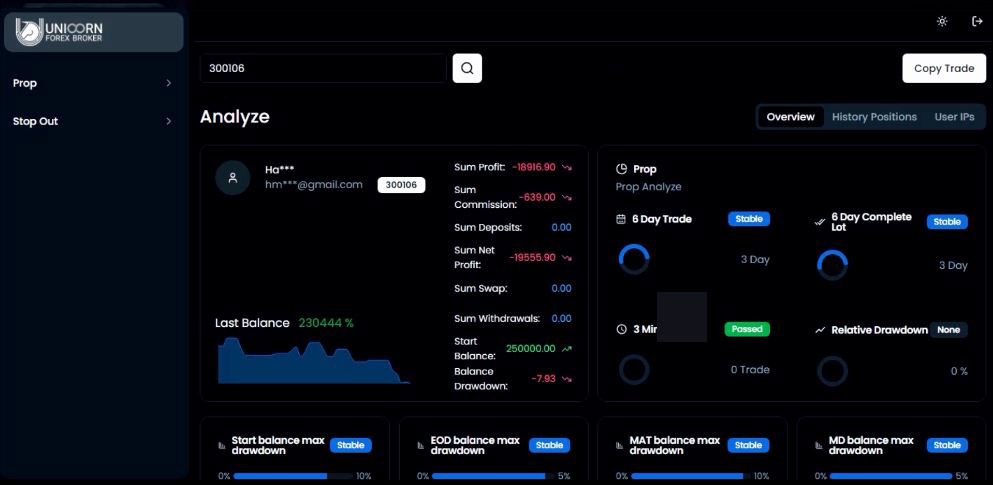

- Drawdown Calculation Plugin

- STOP OUT Plugin

- Liquidity Bridge Provider

- Prop trading analysis plugin

- Education of MetaTrader 5 Manager

- Education of MetaTrader 5 Administrator

- MT5 Chart Data Feed

- MT5 Gateway

- Trading Platform services

- Get in Touch

- Careers